Meaning and Function of Financial Management: A Comprehensive Guide

Defining Financial Management and its Meaning

Financial management is the process of planning, organizing, controlling, and monitoring financial resources to achieve organizational goals and objectives. It involves managing the financial resources of a company, including cash, investments, and credit, to ensure that they are used efficiently and effectively. Financial management is a critical function in any organization, and it plays a vital role in the success or failure of the business.

The primary goal of financial management is to maximize the value of the organization for its stakeholders. This means that financial managers must make sound financial decisions that create value for the company’s shareholders, employees, and customers. Financial management also involves managing the risks associated with financial decisions, such as investments, borrowing, and financing.

Function of Financial Management

As a financial management professional, I have come across many people who are not quite sure what financial management means. In this comprehensive guide, I will explain the financial management, functions. I will also delve into the various tools and techniques that are commonly used in financial management.

Financial Planning and Forecasting

Financial planning and forecasting are essential aspects of financial management. Financial planning involves creating a roadmap for the future financial goals of an organization or individual. It involves setting financial objectives and devising strategies to achieve those objectives. Financial forecasting, on the other hand, involves predicting future financial outcomes based on historical data and current trends.

One of the main objectives of financial planning and forecasting is to ensure that an organization or individual has enough funds to meet its financial obligations. A financial plan helps to identify potential cash flow problems before they occur, and enables the organization or individual to take corrective action.

The process of financial planning and forecasting involves several steps. The first step is to identify the financial goals and objectives of the organization or individual. The next step is to gather and analyze financial data, including income and expenses, cash flow, and balance sheet information. Once this information has been collected and analyzed, financial projections can be made.

Capital Budgeting and Investment Decisions

Capital Budgeting is the process of making investment decisions that involve large amounts of capital. It is an essential aspect of financial management, as it involves determining which investments are worth pursuing and which are not. Capital budgeting decisions can have a significant impact on an organization’s financial performance and long-term success.

The process of capital budgeting involves several steps. The first step is to identify potential investment opportunities. The next step is to evaluate those opportunities using various financial analysis tools, such as the net present value (NPV), internal rate of return (IRR), and payback period. These tools help to determine the potential return on investment, as well as the risks associated with each investment opportunity.

Once the investment opportunities have been evaluated, the final step is to select the best investment option. This involves comparing the potential returns and risks of each investment opportunity and selecting the one that best aligns with the organization’s financial goals and objectives.

Working Capital Management

Working capital management is the process of managing an organization’s short-term assets and liabilities. It involves ensuring that the organization has enough cash and other liquid assets to meet its short-term financial obligations. Effective working capital management can help to improve an organization’s cash flow, reduce its financial risk, and optimize its profitability.

The process of working capital management involves several steps. The first step is to identify the organization’s short-term financial obligations, including accounts payable, taxes, and salaries. The next step is to determine the organization’s short-term assets, including cash, accounts receivable, and inventory.

Once these assets and liabilities have been identified, the final step is to manage them effectively. This involves ensuring that the organization has enough cash on hand to meet its short-term financial obligations, while also optimizing its use of other short-term assets and liabilities.

Financial Analysis and Control

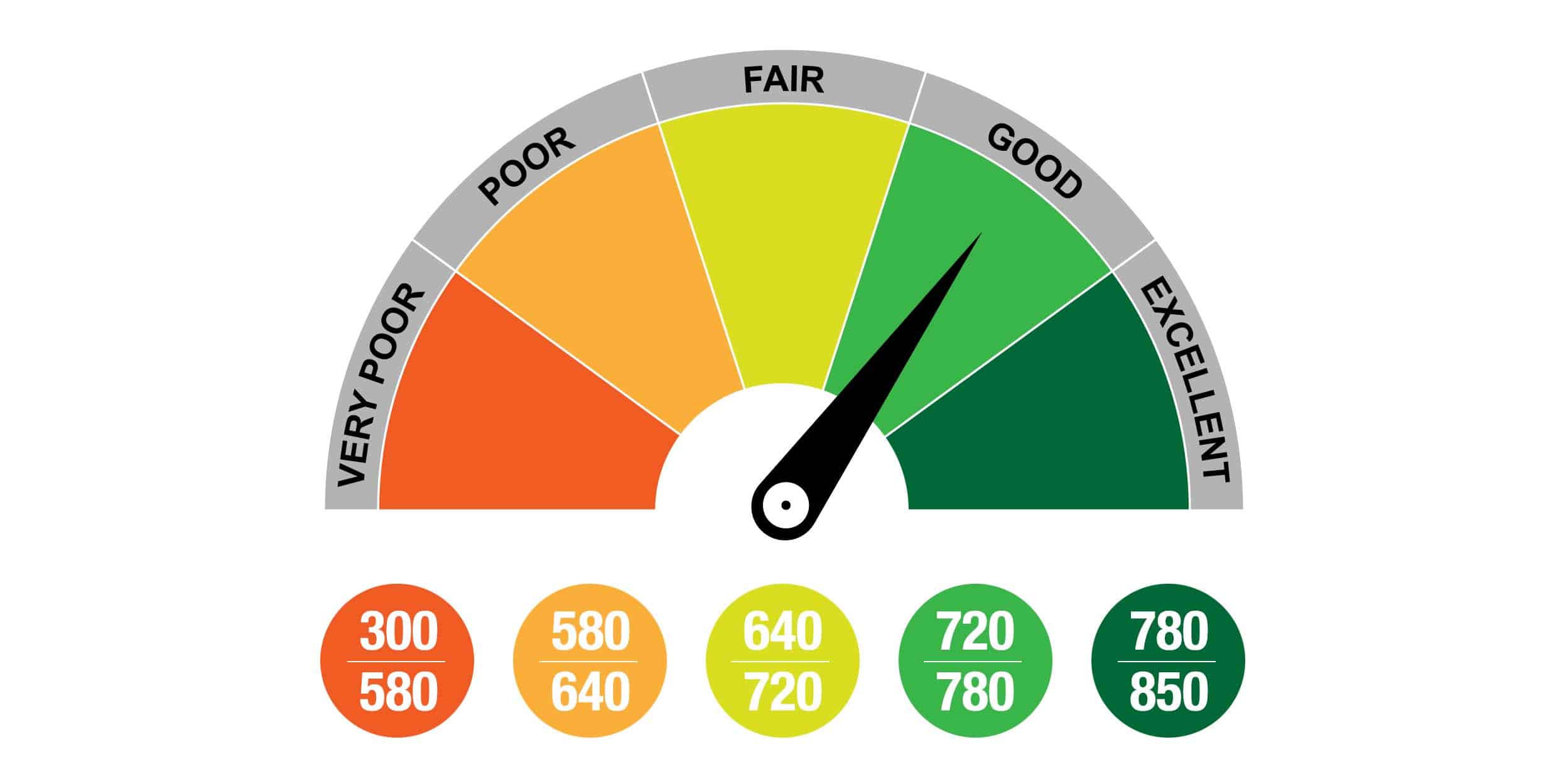

Financial analysis and control are essential aspects of financial management. Financial analysis involves examining an organization’s financial statements to determine its financial health and performance. Financial control involves implementing measures to ensure that an organization’s financial resources are used effectively and efficiently.

The process of financial analysis involves several steps. The first step is to gather financial data, including income statements, balance sheets, and cash flow statements. The next step is to analyze this data using various financial ratios, such as the debt-to-equity ratio and the return on investment ratio. These ratios help to determine the organization’s financial health and performance.

Once the financial analysis has been completed, the final step is to implement measures to ensure financial control. This involves setting financial targets and monitoring the organization’s financial performance to ensure that it is on track to achieve its financial objectives.

Financial Management Tools and Techniques

There are several financial management tools and techniques that are commonly used in financial management. These tools and techniques help to simplify financial management tasks and improve the accuracy and efficiency of financial management processes.

One of the most commonly used financial management tools is a financial management software. This software can help to automate financial management tasks, such as budgeting, financial forecasting, and financial analysis. Other tools and techniques include financial modeling, financial reporting, and financial risk management.

Conclusion

In conclusion, financial management is a critical aspect of any organization or individual’s financial success. It involves planning and forecasting, capital budgeting and investment decisions, working capital management, financial analysis and control, and the use of financial management tools and techniques. By understanding the meaning and scope of financial management, organizations and individuals can make informed financial decisions and achieve their financial goals and objectives.